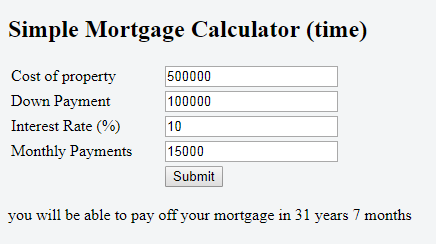

Before I get into finishing writing the second part of my simple Mortgage calculator which calculates how much you have to pay per month if you want your mortgage paid off in a certain time frame, I want to go over how to mathematically value a bond. After this, I will have a bond calculator at a later date programmed in Javascript.

What is a bond?

A bond is a debt instrument used by a company or a sovereign state in order to raise capital. A bond is a contract where, in return for purchasing the bond, the company promises to periodically pay interest for a period of time and at the end of the period pay the principal of the bond.

Of course, there are many types of bonds and many interesting variants, for this one I will only be discussing the straight bond which is a bond that pays a coupon (interest) periodically and then pays back its face-value (principle) when the bond matures.

Market Value vs Face-Value

So – typically at the beginning a company will sell a bond at par, this is when face-value is equal to the market value (typically $100 or $1000) however there are many factors that can change the market value of a bond.

For example, if a company improves its credit rating, the bond will typically become worth more than the face-value. In this situation, the bond is said to be sold at a premium. On the converse, if its credit rating slides, then the bond will sell below par or be sold at a discount. There are other factors such as the interest rate set by the federal reserve bank.

Pricing a Straight Bond

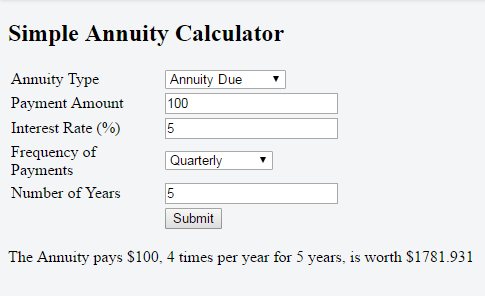

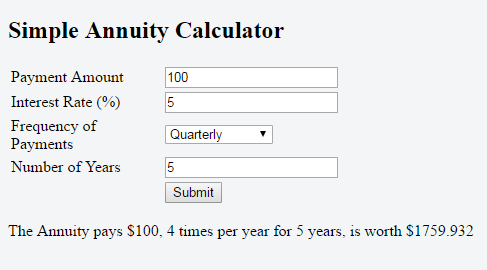

So again from a previous post, we price an asset by discounting its future payouts. The bond however periodically pays a constant rate of payments and then finally a large payment at the end – from here we see that the straight bond is just an annuity, plus an additional lump sum payment.

Here c is the coupon or the interest rate of the bond times the face value of the bond divided by the number of payments per year. r, in this case, is not the interest rate of the bond but the interest rate associated with a company with a certain credit rating. For example, an AAA credit rating would have a lower r, then a BB credit rating. Finally, p is the number of payments per year and t is the number of years.

Now we have the final part of the bond which is the principle that will be paid at maturity. Let’s call this value M. Since M is paid out after t years, we discount it t years with discount rate r, or:

Now we add it together to get the value of our bond:

Let’s take an example. Banana Corporation issues a bond with a $1000 face value and a 5% coupon rate at par and coupons are paid semiannually for 10 years,. This means at the discount rate at this time is 5%.

However all of a sudden we find out that Banana Corporation has a cash flow issues and thus its rating is reduced. This means that the discount rate for Banana Corporation is 7.5% instead of 5%:

Note, even though the discount rate has changed, the coupon rate doesn’t. Thus the bond is now less valuable and is said to be sold at a discount.

Thank you for reading my article, if you found it useful please like and share and if you have any questions please feel free to leave them in the comments – I may use your question for a further post.